arb·it·rage n /ˈɑrbɨtrɑːʒ/

the practice of taking advantage of a price difference between two or more markets.

The image most people have of stock markets is of men (and it is always men) in suits using hand signals and shouted verbal commands to buy and sell stocks and shares; this system is called “open outcry” and in reality is used only very rarely.

The vast majority of trading now takes place via computer, and this has altered the way in which markets operate. Not only are traders using computers, but now the traders are computers, operating at very high speeds to execute pre-programmed trading strategies.

As computer hardware and software have improved it is no longer the speed at which computers operate that is most important, but rather the time taken for light to travel down the optical fibre between trading locations. Typical trading latencies are now below five hundred microseconds, enabling traders to make more than two thousand trades per second.*

Because the speed of light has become the limiting factor the physical location of trading offices is becoming more and more important. Well-positioned traders (if you’ll excuse the pun) can take advantage of the difference in price between two markets – buying low in one market and selling high in another – for a profit.

For example: imagine three traders buying and selling aluminium on the London Metals Exchange through the LMEselect electronic trading system. One trader is located in London, one in Dubai (5500km from London) and the other in Singapore (10800km from London). The speed of light in an optical fibre is about 200 million metres per second so any change in price reaches the London trader almost immediately but takes 28 milliseconds to reach Dubai and 54 milliseconds to reach Singapore. The trader in Dubai has an extra 26 milliseconds to act – enough time for more than fifty 500 microsecond trades – before the information reaches Singapore. If the trader in Dubai is trading metals in both London and Singapore then it becomes possible to buy low in London and sell high in Singapore before price information can pass between the two.

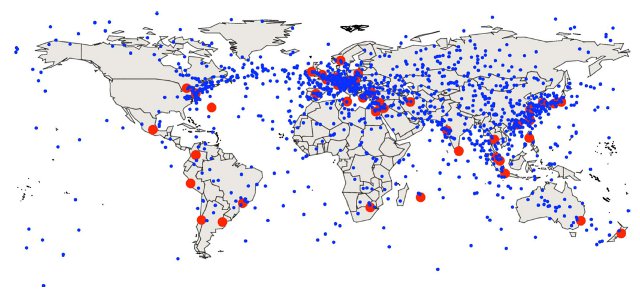

In a recent paper†, academics Alexander Wissner-Gross and Cameron Freer show that “there exist optimal locations from which to coordinate the statistical arbitrage of spacelike separated securities” and plot these locations on a map.

The red dots represent exchanges, the blue dots the optimal location of trading nodes between each pair of exchanges.

As the authors point out:

“[W]hile some nodes are in regions with dense fibre-optic networks, many others are in the ocean or other sparsely connected regions, perhaps ultimately motivating the deployment of low-latency trading infrastructure at such remote but well-positioned locations.”

This suggests that the location of exchanges and the speed of light may become the deciding factors as to where trading offices are sited.

* See, for example, Tara Bhupathi. 2010. “Technology’s Latest Market Manipulator? High Frequency Trading: the Strategies, Tools, Risks, and Responses”, North Carolina Journal of Law & Technology 11(2): 377-400.

† Alexander Wissner-Gross and Cameron Freer. 2010. “Relativistic Statistical Arbitrage”. Physical Review E 82(5): 056104-056110. doi:10.1103/PhysRevE.82.056104